Whether you're hosting a one-hour webinar, a three-day conference, or a 24/7 content destination, BigMarker provides a powerful platform to produce, publish, and generate actionable data around great content.

Host interactive streams that inspire your audience and generate powerful data.

Explore Webinars →

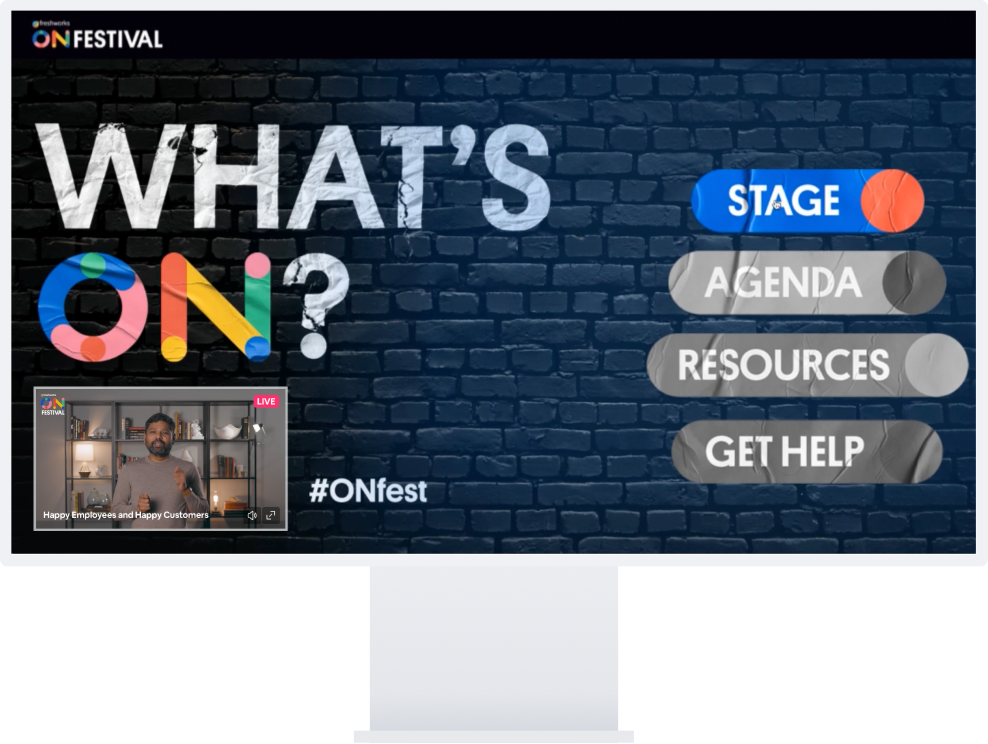

Host customizable virtual events with ticketing, networking & sponsors built-in.

Explore Virtual Events →

Create an elevated experience for in-person and virtual attendees on the same platform.

Explore Hybrid Events →

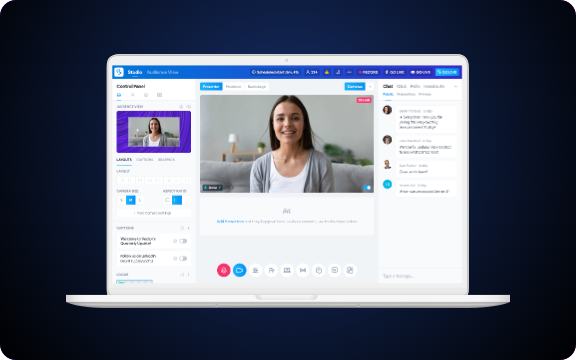

Produce broadcast-quality video content, live stream, record and repurpose.

Explore Studio →

Create on-demand content experiences that engage your audience 24-7-365.

Explore Media Hubs →

Connect your data back to your CRM, no matter how complex your implementation is.

Explore Integrations →

BigMarker provides everything you need to design, build, and execute an impactful virtual conference, industry convention, trade show, town hall, or customer event.

Learn more about Virtual Events →

BigMarker's webinar software is not another super-sized video conferencing tool -- it's built from the ground up for audience engagement and demand generation.

Whether your audience is on-site, at home, or both, BigMarker's hybrid events software is designed to help you elevate your attendee experience from a single data-driven platform.

After analyzing over one million webinars hosted by B2B marketers on BigMarker in the past year, we present webinar best practices with an emphasis on benchmarking and optimizing performance.

Today's customers want to know what they will gain by attending your event. This Guide will give you the tools to plan a top-notch event that takes a customer-first approach to help you stand out from the crowd.

BigMarker has achieved the #1 customer satisfaction rating in G2‘s Webinar Software category, as well as high rankings in other categories including events, lead retrieval, live streaming, and mobile event apps.

We’re available to provide pricing and guided tours of our webinar, virtual, hybrid & in-person event solutions.

Request a Demo